Strengthening Liquidity Frameworks: New Moody’s Bank Credit Methodology Stemming from Lessons Learned Related to SVB on Operational Deposits

SVB Liquidity-Related Matters Requiring Attention

When Silicon Valley Bank (SVB) collapsed in March 2023, the Federal Reserve (“Fed”) had several unresolved supervisory letters containing matters requiring attention (MRAs) related to liquidity risk management.

Specifically, a November 2021 liquidity supervisory letter noted a key MRA concerning SVB’s internal liquidity stress testing framework. The Fed observed that SVB’s deposit segmentation was overly simplistic and failed to differentiate by product type, customer type, or operational versus non-operational deposit classification. This treatment unrealistically assumed that all deposit types would behave similarly under stress. Consequently, the Federal Reserve Bank of San Francisco mandated that SVB enhance its deposit segmentation to reflect deposit runoff more accurately, including distinction between operational and non-operational deposits, product types, and counterparty types.

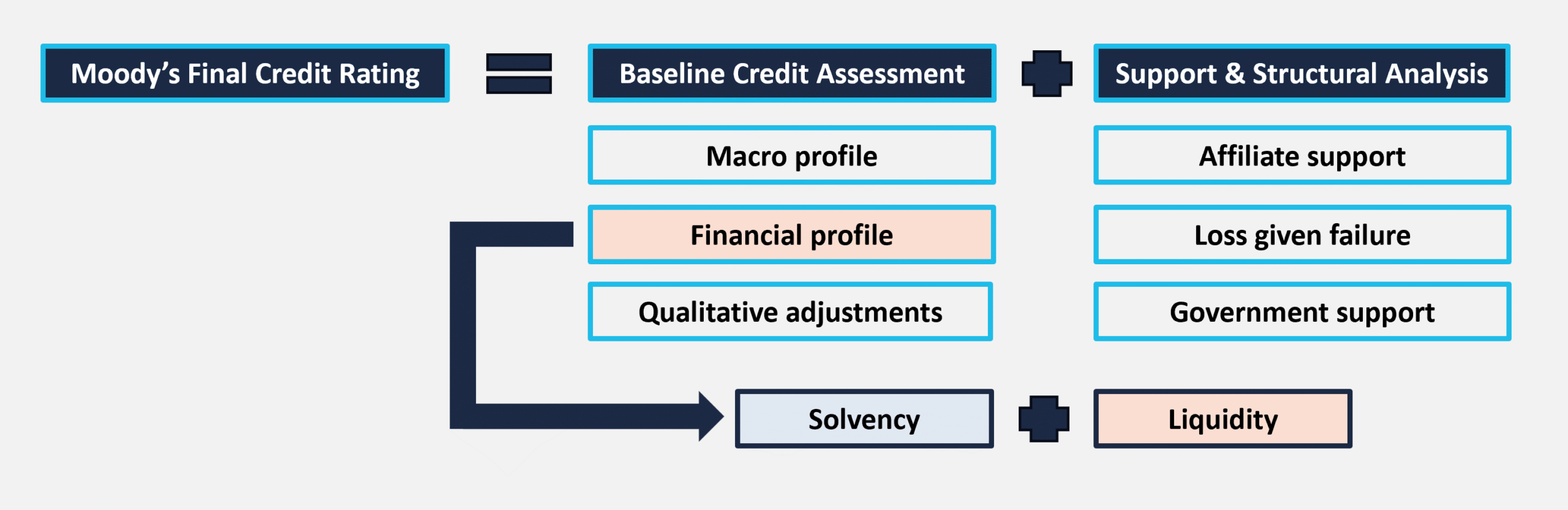

Updates to Moody’s Bank Credit Rating Methodology

Moody’s has recognized the importance of a strong liquidity risk foundation in its credit rating methodology. After a request for comment in May 2025, Moody’s changed its bank rating methodology in November 2025 to reflect “insights…gleaned from adverse credit events…” The new approach “enhance[s the] focus on the quantitative assessment of less-stable funding.

As a result, Moody’s has incorporated deposit runoff assumptions into the liquidity subfactor of its bank credit rating methodology to reflect how deposits behave under stress. Figure 1 displays the calculation and highlights affected areas.

Figure 1 Moody’s Bank Credit Rating Methodology

For banks that publish liquidity metrics, Moody’s will incorporate deposit runoff assumptions directly from those reports. For banks that do not report liquidity metrics, Moody’s will apply assumptions consistent with Liquidity Coverage Ratio (LCR) regulation. This revised methodology will benefit institutions that model liquidity metrics, as they can more accurately demonstrate the stability of their funding sources.

Liquidity Risk Metrics

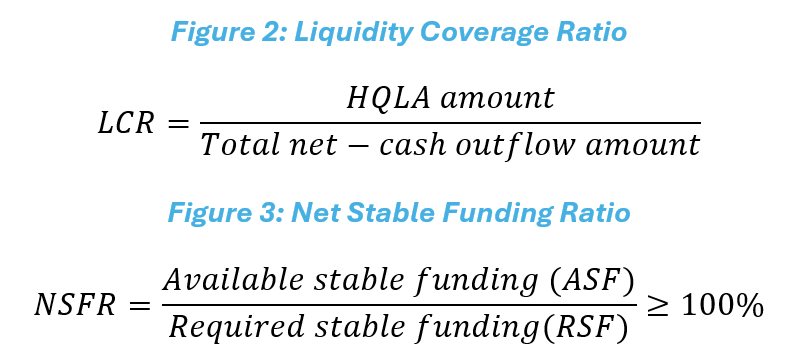

Institutions need to meet certain requirements for LCR and Net Stable Funding Ratio (NSFR) once they reach specific thresholds.

The LCR requires banks to have sufficient high-quality liquid assets (HQLA) to meet total-stress net-cash outflows over a thirty-day period, while the NSFR is designed to promote stable funding of banks’ balance sheets over a one-year horizon. Operational deposits contribute to the denominator of the LCR (with a 25 percent outflow rate—5 percent if entirely covered by deposit insurance and 25 percent if not entirely covered by deposit insurance) and numerator of the NSFR (with a 50 percent weight). Both ratios are shown in Figure 2:

Table 1 displays the regulatory requirements for banks based on size:

Table 1: LCR and NSFR Regulatory Requirements Based on Size

| Category | Size | LCR | NSFR |

| I | Global Systemically Important Bank Holding Companies (G-SIBs) | 100% | 100% |

| II | $700 billion | 100% | 100% |

| III | $250 billion (WSTWF > $75 billion) | 100% | 100% |

| $250 billion (WSTWF < $75 billion) | 85% | 85% | |

| IV | $100 billion (WSTWF > $50 billion) | 70% | 70% |

Therefore, there is significant financial benefit for institutions to have deposits classified as operational for purposes of both ratios, given the 25 and 50 percent weighting.

Financial institutions approaching the Category IV threshold are required to start developing a more formal liquidity risk management framework. Accurately identifying operational deposits is critical to this process. Given the changes in Moody’s rating methodology, segregating operational deposits will also significantly help banks with assets under $100 billion with improved credit ratings (especially those institutions with large wholesale commercial deposit balances).

Defining Operational Deposits

Operational deposits are cash held by a financial institution in wholesale deposit accounts that provide support for its day-to-day operations. Non-operational deposits are surplus funds that may go beyond what is necessary for operational needs, such as investment purposes or strategic reserves. Deposits have to meet seven requirements to qualify as operational (Table 2).

Table 2: Operational Deposit Requirements

| Requirement | Description |

| Legally binding agreement | Services must be performed under a legally binding written agreement with either a >30-day notice period for termination or significant switching/termination costs for the customer. |

| Operational account | Deposits must be held in an account designated as operational. |

| Primary purpose requirement | Customer must hold the deposit at the FDIC-supervised institution for primary purpose of obtaining operational services provided by the FDIC-supervised institution. |

| Excess balances | Accounts must not offer incentives that encourage customers to leave extra funds, such as increased revenues, reduction in fees, or other offered economic incentives. |

| Empirical linkage and volatility methodology | Banks must show that the deposit directly supports operational services and has a methodology that takes the volatility of the average balance into account for identifying excess balances, which must be excluded from the operational deposit account. |

| Prime brokerage exclusion | Deposits must not be provided in connection with the FDIC-supervised institution’s provision of prime brokerage services. |

| Correspondent bank overnight placements | Deposits must not be part of arrangements where the FDIC-supervised institution (as the correspondent) holds deposits owned by another depository institution bank (as the respondent) and the respondent temporarily places excess funds in an overnight deposit with the FDIC-supervised institution. |

Table 3 shows services that fall under the umbrella of operational deposits, given that they are performed as part of cash management, clearing, or custody services.

Table 3: Operational Deposit Services

| Services |

| Payment remittance |

| Administration of payments and cash flows related to the safekeeping of investment assets, not including the purchase or sale of assets |

| Payroll administration and control over disbursement of funds |

| Transmission, reconciliation, and confirmation of payment orders |

| Daylight overdraft |

| Determination of intra-day and final settlement positions |

| Settlement of securities transactions |

| Transfer of capital distributions and recurring contractual payments |

| Customer subscriptions and redemptions |

| Scheduled distribution of customer funds |

| Escrow, funds transfer, stock transfer, and agency services, including payment and settlement services, payment of fees, taxes, and other expenses |

| Collection and aggregation of funds |

Common Issues and Challenges

Institutions face numerous issues in managing operational deposits, including:

- Capturing sufficient data: Institutions must gather enough high-quality data. Institutions must determine an appropriate period (e.g., several months) of historical data to analyze.

- Ensuring switching/termination costs: Identifying operational deposits involves meaningful switching or termination costs to the customer. This can be ensured either through service usage metrics or the terms laid out in account agreements.

- Tagging operational accounts: Institutions must determine whether responsibility falls under business or treasury. Additionally, financial institutions need a methodology to address treatment of zero balance accounts (ZBAs) and multiple accounts under a single customer.

- Modeling excess balances: Institutions must model and isolate excess balances from those actually needed for operations. This includes setting lookback windows, deciding how to handle newly opened accounts, and ensuring outflows used in models are service related (rather than automated or customer-initiated transfers). Additionally, earnings credit rates (ECRs) must be removed if they exceed the value of actual services provided.

- Governance framework: Organizations need to determine whether business or treasury is responsible for ongoing identification and processes for initial classification, onboarding of new accounts, and related ongoing monitoring.

Tests Related to Modeling Excess Balances

Institutions will need a defensible methodology in terms of how they model excess balances. The Surge Balance and Debit Payments tests, which together cap temporary spikes and validate that balances reflect real outgoing payments, serve as key components of this framework.

- The Surge Balance Test detects short-term spikes in balances that are unlikely to be stable or operational, helping to prove that the operational deposits are based on the customer’s ordinary cash-management needs, not temporary inflows. Specifically, it classifies recent deposit increases as excess balances for the client based on capping the amount of operational balance at the three-month average and comparing the spot-month balance to the capped limit.

- The Debit Payments Test shows that a client’s post-surge balances are tied to regular payment activity, such as payroll, ensuring that balances are operational as they are used to meet routine outflows. The test is applied to post-surge test operational balances to identify the portion of client balances that are tied to payment activity based on comparison to six-month average of debit outflows.

Going Forward

Effectively managing operational deposits is necessary to maintain a strong liquidity risk profile. In the aftermath of SVB’s failure, regulators have focused increasingly on the need for rigorous liquidity risk frameworks, and Moody’s updated methodology puts further emphasis on deposit runoff assumptions. Institutions that invest in developing a comprehensive operational deposit methodology with a data-driven approach will secure a strong liquidity foundation in a more dynamic interest rate—and uncertain economic—environment.

Related Professionals

Related Industries

Prepare for what's next.

ThinkSet magazine, a BRG publication, provides nuanced, multifaceted thinking and expert guidance that help today’s business leaders adopt a more strategic, long-term mindset to prepare for what’s next.