Adapting to the New Debanking Rules: How Financial Institutions Can Prepare

On August 7, 2025, the White House issued an executive order (EO), “Guaranteeing Fair Banking for All Americans,” aimed at prohibiting financial institutions from engaging in politicized or unlawful debanking practices. The order states that some financial institutions have targeted individuals associated with conservatism and flagged lawful transactions due to political affiliations. The order asserts that bank regulators have tacitly encouraged such practices, citing initiatives such as “Operation Chokepoint,” in which regulators allegedly pushed financial institutions to reduce banking access for both companies and individuals based on factors beyond acceptable risk-based standards, such as politicized motive. This article describes in more detail the requirements proposed by this order and implications for financial institutions.

What is debanking? What organizations does this executive order impact?

Debanking refers to the practice of financial institutions restricting individuals, companies, or entire industries from accessing financial services or products, specifically for reasons beyond individualized, risk-based factors. In the context of the EO, debanking references institutions that restrict such access due to customers’ political affiliations, religious beliefs, or lawful business activities. Examples of industries that have been allegedly impacted by such practices include cryptocurrency and cannabis, while individual companies include Cabela’s and Bass Pro Shop. Additionally, the order cites the Equal Credit Opportunity Act, Section 5 of the Federal Trade Commission Act, and Section 1031 of the Consumer Financial Protection Act as grounds for enforcing findings related to debanking.

This EO applies broadly across the financial services sector, mentioning banks, savings associations, credit unions, and other financial services providers as in-scope. Essentially, this EO impacts all financial institutions by shifting debanking from a reputational or discretionary risk decision into a defined compliance requirement. Regardless of size, business model, or customer base, institutions will need to update or reconsider their policies, procedures, and risk frameworks to ensure alignment with the requirements outlined in the order. Already, the Small Business Administration (SBA) and Office of the Comptroller of the Currency (OCC) have published news releases committing to eliminate politicized or unlawful debanking, and the acting chairman of the Federal Deposit Insurance Corporation (FDIC) released a statement indicating “the FDIC fully supports President Trump’s Executive Order on politicized or unlawful debanking.” Additionally, on October 7, the OCC and FDIC issued a joint notice of proposed rulemaking to “codify the elimination of reputation risk from their supervisory programs.”

What actions does the executive order require?

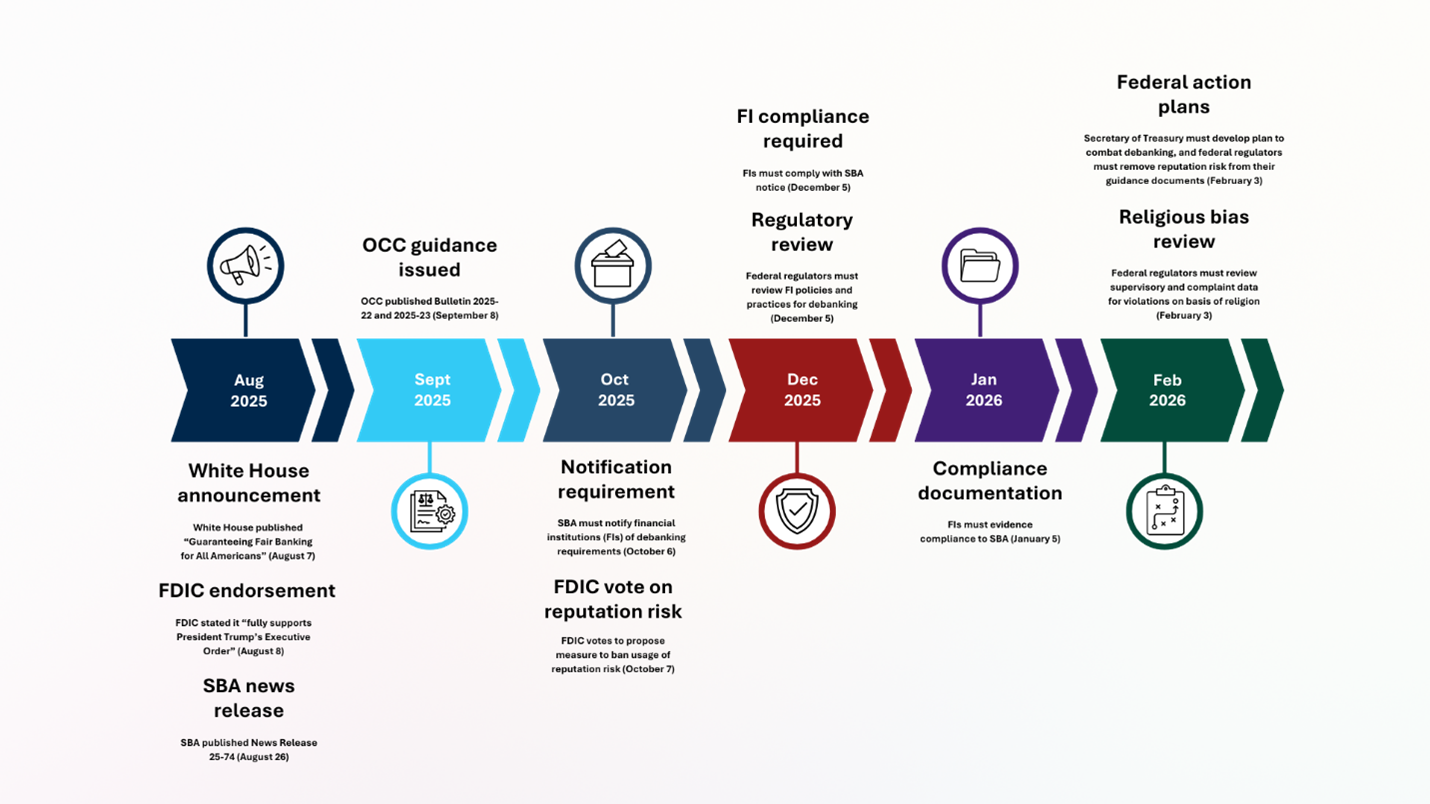

The timeline below highlights key deadlines as of the time of this article, along with proposed agency actions stemming from this EO and subsequent regulator announcements, providing financial institutions with a clear view of when critical compliance obligations and supervisory changes will take effect.

Figure 1. Timeline Surrounding the EO

This EO outlines specific actions for both federal banking regulators and financial institutions.

For federal banking regulators:

- Within 180 days of the order’s issue, remove reputation risk from all regulatory guidance and exam manuals; and consider revising regulations currently enabling politicized or unlawful debanking.

- Within 180 days, the secretary of the Treasury and assistant to the president for Economic Policy must develop a comprehensive strategy to further eliminate politicized or unlawful debanking, including consideration of legislation or regulatory options.

- Within 120 days, perform a look-back assessment to identify institutions subject to regulator’s jurisdiction that have either engaged in or encouraged politicized or unlawful debanking; and take remedial action, including issuing fines and consent orders.

- Within 180 days, review supervisory and complaint data for instances of unlawful religion-based debanking; and refer instances of noncompliance to the attorney general to face civil action.

- Within 60 days, SBA must provide notice to all institutions under its jurisdiction of the following requirements:

For financial institutions under the jurisdiction of the SBA:

- Within 120 days of the order’s issue, make reasonable efforts to identify and reinstate previous customers that had been denied services due to debanking practices; and provide a notice of reinstatement.

- Within 120 days, identify previous potential clients that also had been denied services due to debanking practices; and provide a notice stating the renewed option to utilize such services.

- Within 120 days, identify previous potential clients that had been denied payment processing services due to debanking practices; and provide a notice stating the renewed option to utilize such services.

What is the impact for financial institutions?

Financial institutions must take actions beyond those listed in the EO to ensure future compliance with these policies. For example, they should adjust risk models to remove reputation-based decisioning and modify governance frameworks to adapt with the new rules. Additionally, they should update policies, procedures, and staff training to reflect the new guidelines on what factors can drive adverse decisioning. OCC Bulletin 2025-22 states that, as part of its review on licensing filings, the OCC considers “a bank’s record of and policies and procedures designed to avoid engaging in politicized or unlawful debanking consistent with the applicable evaluative factors.” This demonstrates that regulators are evaluating not only customer-level decisions, but also broader processes and frameworks institutions have in place to prevent unlawful debanking.

While the EO seeks to eliminate politicized or unlawful debanking, it does not relieve institutions of existing obligations under the Bank Secrecy Act (BSA) and related anti-money laundering (AML) requirements. OCC Bulletin 2025-23 reiterates that banks must continue to protect customers’ financial records and appropriately use suspicious activity reports. Institutions will need to clearly document and evidence that account terminations or denials are driven by legitimate BSA/AML risk considerations, rather than non-risk–based factors.

Financial institutions should also prepare for supervisory scrutiny and enforcement and expect intense examiner review of decision-making processes and complaint tracking. As stated in SBA News Release 25-74, “SBA Orders Lenders to End Practice of Debanking,” institutions under the jurisdiction of the SBA “must submit a report to the SBA by January 5, 2026, addressing and evidencing their compliance with the above directives to remain in good standing with the agency and avoid punitive measures.” Compliance will be tested through concrete reporting obligations and agency oversight, meaning that institutions should begin preparing now to evidence compliance in advance of the deadline.

How can BRG help?

BRG experts have significant experience helping clients navigate rapidly changing regulatory environments. Our team includes seasoned industry and government leaders who have guided financial institutions in identifying gaps in existing policies and procedures, recalibrating risk models to align with regulations, and implementing governance structures that withstand regulatory scrutiny. We have supported some of the most high-profile look-back reviews in the industry, giving us a unique perspective on regulatory expectations and best practices. We understand the challenges this EO poses and can provide actionable solutions that meet the needs of each client. As an industry leader in regulatory compliance, we are equipped to help financial institutions of all sizes navigate this environment.

Figure 2. Key Compliance Focus Areas and Risks and BRG Experience

Related Professionals

Related Services

Related Industries

Prepare for what's next.

ThinkSet magazine, a BRG publication, provides nuanced, multifaceted thinking and expert guidance that help today’s business leaders adopt a more strategic, long-term mindset to prepare for what’s next.