Global Trade and Compliance

Solutions for Twenty-First-Century Trade Challenges

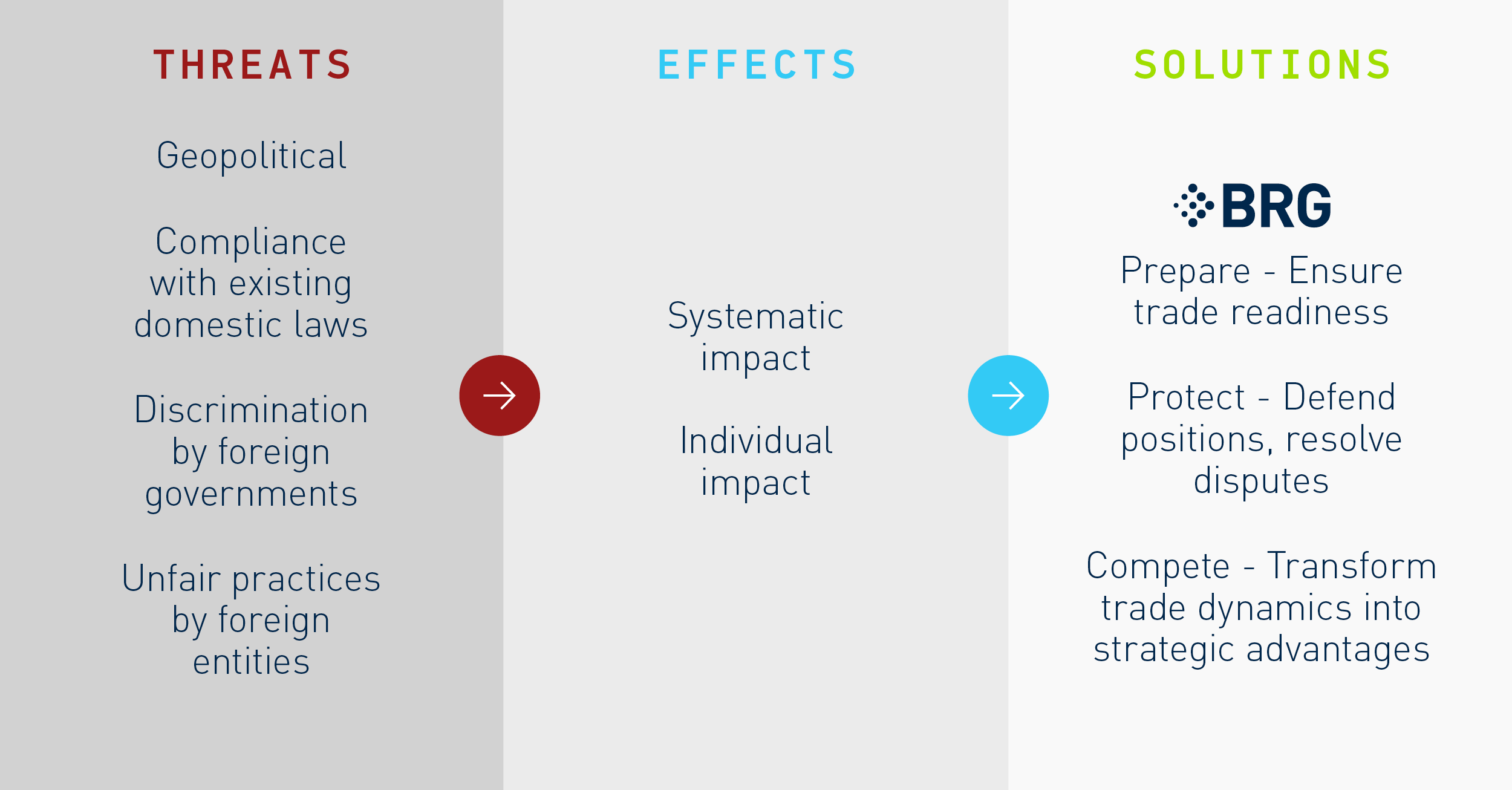

As the global trade order enters uncharted waters, we help organizations prepare for change, protect enterprise value, and compete across international markets.

Global trade and compliance challenges are no longer peripheral. They sit at the center of organizations’ strategic decision-making.

Around the world, companies of every size and sector are struggling to navigate geopolitical uncertainty, erratic trade regulation, ever more stringent compliance obligations, discriminatory foreign practices, and unfair competitive behavior.

From export controls and sanctions to investment restrictions, supply chain vulnerabilities, and high-profile trade disputes, these pressures increasingly affect companies’ financial performance and strategic flexibility.

BRG’s Global Trade & Compliance experts partner with companies and their counsel to mitigate risks, unlock opportunities, and make informed, defensible decisions across the full life cycle of global trade and investment—including compliance, policy analysis, strategic advisory, due diligence, litigation, arbitration, and investigation support.

How We Help

Seismic shifts in the trade and investment landscape have become a board-level concern. Here is how we help organizations solve their most pressing problems.

Prepare. Protect. Compete.

Prepare

Ensure trade readiness by preparing for market entry, transactions, and regulatory change

We help clients anticipate, manage, and mitigate trade, national security, and compliance risks—whether in relation to market entry, transactions with a new trade partner, or shifts in trade and industrial policy.

- Reduce trade uncertainty by applying scenario planning, sensitivity tests, matrix analyses, and forecasting to evaluate the geopolitical and trade landscape.

- Evaluate national security and investment‑control risks in cross‑border transactions.

- Engineer resilient supply‑chain strategies by identifying tariff, country, and third‑party risks embedded in sourcing, production, and distribution models.

- Conduct trade, subsidy, and compliance due diligence for mergers and acquisitions (M&A) and strategic investments.

- Analyze exposure to novel trade-related regulations and policies, including tariffs, industrial policy, forced‑labor regimes, data privacy, and environmental, social, and governance (ESG)‑linked import restrictions.

Protect

Defend positions and resolve disputes

By providing independent, defensible support grounded in data and economics, we help organizations build durable compliance programs, respond to regulatory scrutiny, and defend their positions when trade and national security issues escalate into investigations or disputes.

- Support trade disputes and enforcement matters with data‑driven analysis, including quantification of exposure and economic impact.

- Defend clients in trade‑related investigations involving export controls, sanctions, customs, and foreign-investment enforcement actions.

- Design, test, and enhance compliance programs to meet regulator expectations while enabling efficient global operations.

- Design regulatory engagement and resolution strategies including voluntary disclosures, remediation planning, and monitorship readiness.

- Provide independent, regulator‑ready assessments to withstand scrutiny from enforcement agencies, counterparties, and courts.

Compete

Transform complex trade dynamics into strategic advantage

We help clients identify and pursue opportunities created by shifting trade policies, regulations, and government support and intervention programs. We develop strategies that enhance market access, operational flexibility, and long‑term growth across jurisdictions.

- Design pragmatic and actionable trade strategies that align with business objectives.

- Quantify the commercial impact of trade policies and regulations to support strategic decision-making.

- Shape trade policy through active participation and improved government engagement.

- Identify trade exemptions and negotiate tariff and regulatory waivers.

- Unlock value from industrial-policy initiatives and pro-trade government support programs.

Our Capabilities

Strategic Trade Policy Advisory

Evidence-based insight to navigate trade risks and unlock opportunities

- Global value chain and country-exposure analysis

- Trade risk identification, assessment, and mitigation

- Trade policy forecasting and scenario planning

- Tariff, sanctions, and industrial policy impact modeling

- Supply chain mapping and resilience analysis

- National security, investment screening, and industrial policy advisory

- Trade policy engagement, advocacy, and negotiation support

Why BRG

Clients turn to BRG when trade and compliance issues demand more than legal interpretation. Our experts specialize in the cross-border flow of goods, services, capital, ideas, and people, covering the full spectrum of clients’ trade and investment needs.

Our teams combine:

- Extensive trade, investment, and compliance expertise including experts who have received the highest recommendations from organizations such as Lexology Index, Foreign Investment Watch, and Chambers Global Guide.

- PhD-level economic and quantitative analysts who deliver rigorous modeling and decision-grade analysis.

- Deep-seated fluency across sectors from construction and commodities, engineering, and life sciences to e-commerce, technology, and artificial intelligence.

- Operational, investigative, and regulatory experience spanning audits, monitorships, strategy consulting, and complex sector-specific matters.

- Agency‑level experience with professionals who have advised on matters involving the US Department of Justice, Bureau of Industry and Security, and Office of Foreign Assets Control, as well as global regulatory and enforcement authorities.

- Global perspective with local execution, combining local know-how of the Americas, Europe, the Middle East, Africa, and Asia-Pacific with global best practices.

Our deep bench of experts in trade-adjacent fields—including antitrust and competition, national security, ESG, cybersecurity, international taxation, international arbitration, investor-state disputes, foreign asset control, digital trade, data privacy and security, and forensic accounting—enables us to assess intended and unintended consequences of trade-related rules, regulations, and policies worldwide.

This integrated approach allows us to evaluate not only legal risk but commercial impact, feasibility, and defensibility in real-world settings to ensure optimal outcomes for clients.

Insights

Don’t Celebrate—Yet: From Signals to Rule in the US, Enforcement Still Decides the Truce

Steve Klemencic and Robert Chamberlain discuss how what both capitals call a “pause” has started to cross from signal into a formal regulatory stay on the US side—while China’s side remains administrative and discretionary.

Don’t Panic—Yet: China’s Rare Earth Gambit Is Political Chess, Not All‑Out War

Steve Klemencic and Robert Chamberlain argue that the real inflection point will come when Beijing’s internal balance of power becomes clear and APEC determines whether diplomacy remains viable.