Plugging the Gap: How US Well Abandonment Could Become the Next Carbon Investment Frontier

Over the last decade, capital has rushed into “green‑only” themes: early‑stage clean technology, frontier climate solutions, and high‑beta transition trades. As monetary conditions have tightened and high‑expectation narratives disappointed, investors have shifted focus toward capital‑efficient, technically proven, and measurable decarbonization strategies. At the same time, pressure on energy producers to cut emissions—especially methane—has intensified.

An underappreciated opportunity sits in plain sight: the legacy inventory of inactive and orphaned oil and gas wells scattered across the United States. Long viewed solely as an environmental and financial liability, this stock of wells can, under the right structures, be transformed into an investable carbon‑asset class. By systematically plugging and abandoning (P&A) leaking wells and quantifying the resulting methane abatement, project sponsors can generate high‑integrity carbon credits, reduce long‑tail liabilities, and unlock infrastructure‑style returns.

For exploration and production (E&P) companies, oilfield service providers, industrial players, and private capital, the convergence of methane‑reduction priorities, federal funding, and maturing carbon‑credit methodologies has created a new, scalable frontier in the energy transition.

The Scale of the US Challenge

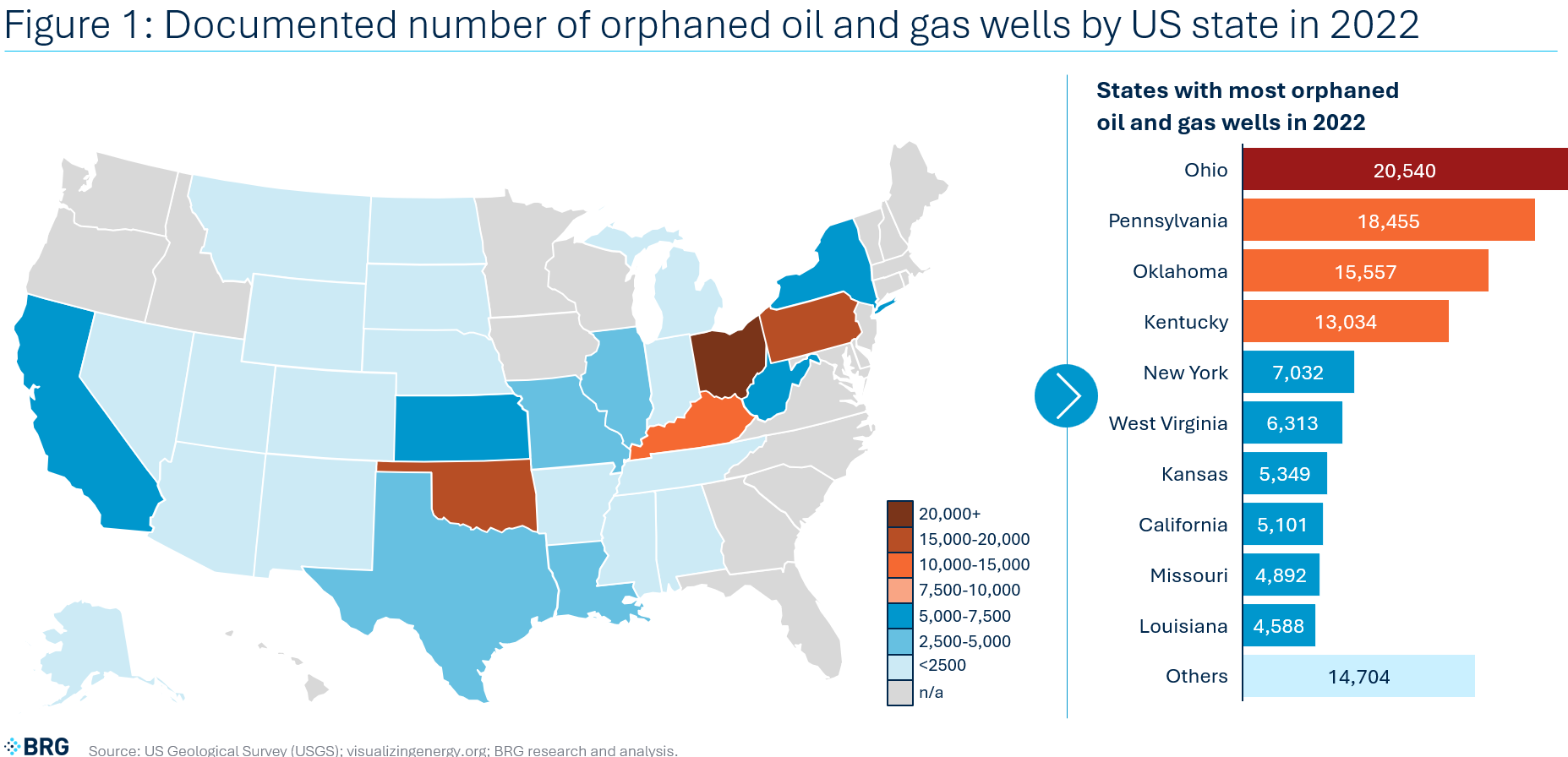

The United States has drilled millions of oil and gas wells over the last century. Many are now inactive, poorly documented, or entirely orphaned. Estimates suggest roughly 3.5 million onshore wells fall into the “abandoned” category, including both plugged and unplugged wells, with a substantial fraction either not properly sealed or not monitored over time. Within this broader universe, nonprofit and academic assessments put the number of orphaned or abandoned wells in the two to three million range, with over 120,000 documented unplugged orphan wells already identified by regulators (and estimates of another 250,000 to over 740,000 wells undocumented due to unknown location or unclear ownership).[1]

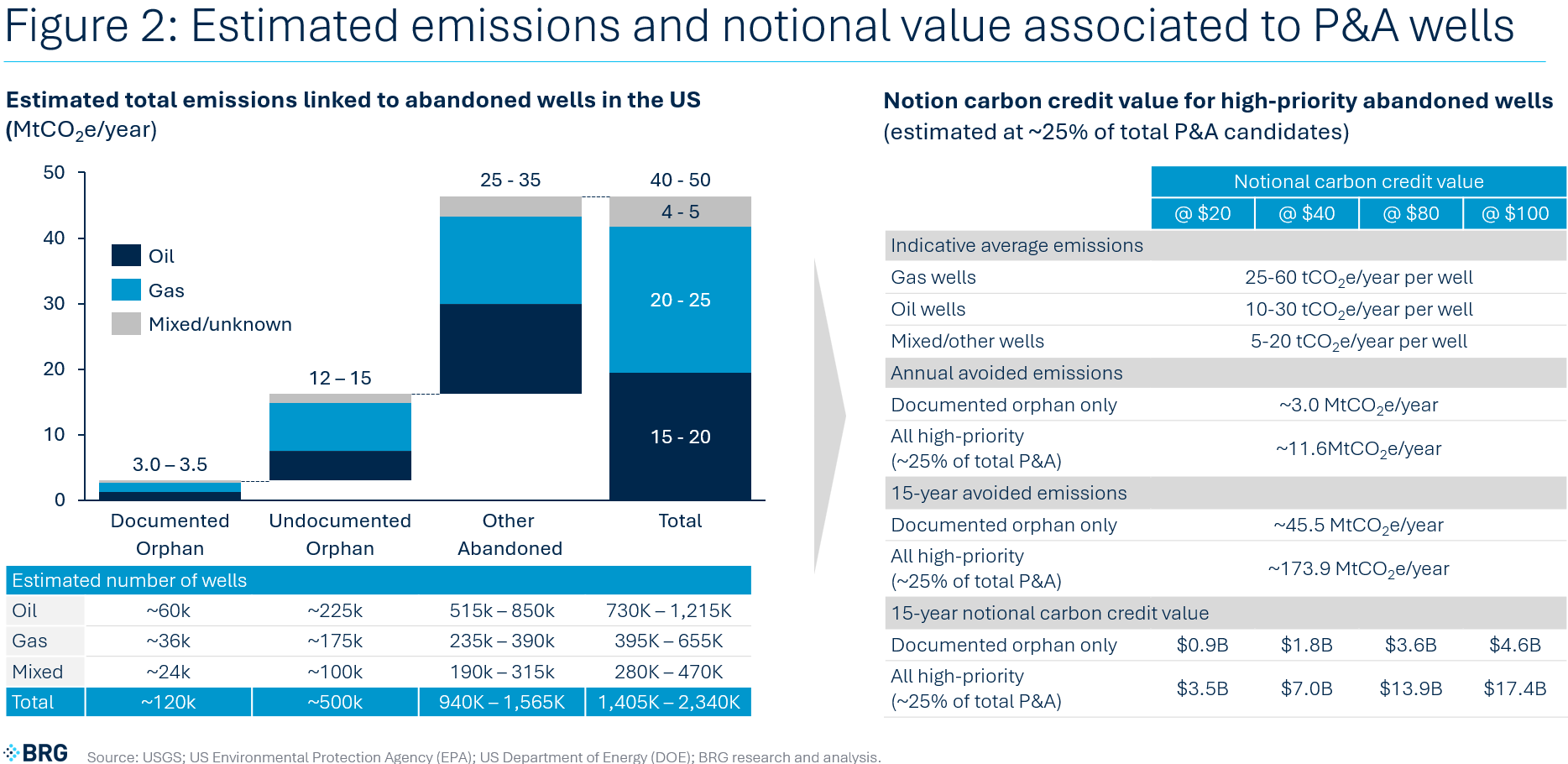

Methane emissions from this legacy inventory are increasingly recognized as a significant climate‑risk vector. Measurements at sample sites show that many abandoned and orphaned wells emit methane at rates that, while modest on a single‑well basis, add up to meaningful totals when scaled across hundreds of thousands of sites. When converted using methane’s global-warming potential—more than twenty‑eight times that of carbon dioxide (CO₂) over a 100‑year horizon—annual emissions from US abandoned wells translate into millions of tons of CO₂‑equivalent (tCO2e). In other words, a diffuse but addressable source of potent greenhouse gases (GHG) sits literally embedded in the landscape.

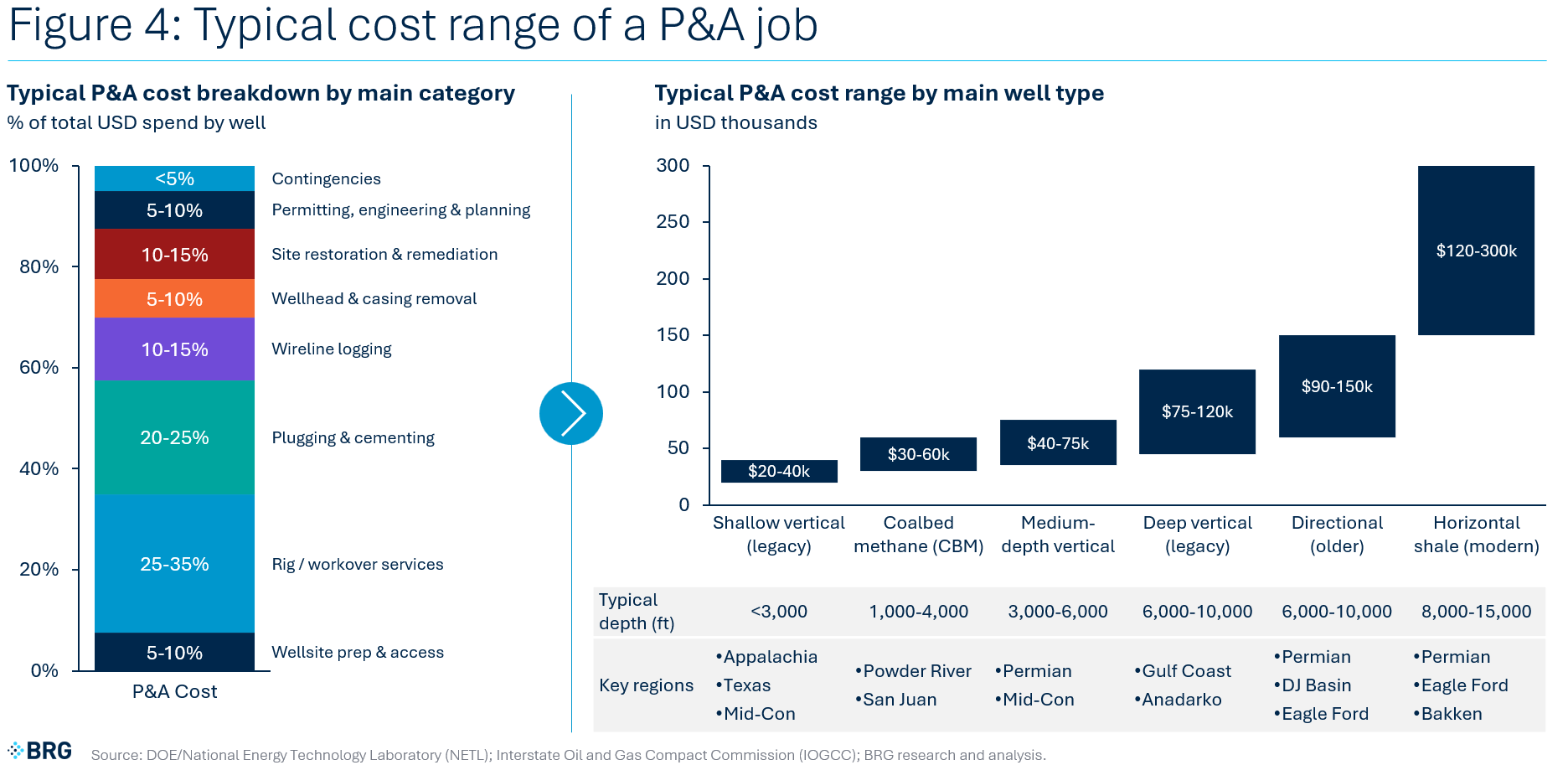

The financial liability is similarly large. Plugging, site remediation, and monitoring typically cost from tens of thousands of dollars up to low six figures per well depending on depth, geology, location, and legacy condition. State and federal agencies collectively face a multibillion‑dollar remediation bill, while private operators carry on their balance sheets asset‑retirement obligations (AROs) that stretch years into the future. This combination of large‑scale emissions and cost creates a natural opening for new business models that monetize avoided methane through carbon markets.

From Environmental Liability to Carbon Opportunity

Traditionally, P&A activity has been treated as a non‑negotiable cost of doing business: a regulatory requirement and environmental obligation to be managed as efficiently as possible, but never a source of revenue. Viewing P&A through a carbon‑market lens fundamentally changes the equation.

A properly plugged and monitored well prevents future fugitive methane emissions that would otherwise continue for years or decades. Those avoided emissions can be quantified, converted into CO₂‑equivalent, and—subject to robust methodologies and verification—issued as carbon credits. Three characteristics make this particularly compelling:

- Permanence: Once a well is correctly sealed, monitored, and, where necessary, remediated, the underlying source of the leak is removed in a way that is difficult to reverse. This contrasts with many nature‑based solutions that carry reversal risk from fires, disease, or land‑use change.

- Additionality: For much of the legacy well stock, especially orphan wells with no solvent operator, plugging would not occur on a timely basis without targeted programs or new economic incentives. Crediting can therefore be structured to reflect genuine incremental abatement.

- Measurability: Methane emissions from abandoned wells are explicitly recognized in GHG inventories, and field campaigns have established practical measurement approaches for both baseline leak rates and post‑plug performance.

When these elements are in place, the arithmetic can become attractive. Consider a stylized well with a baseline methane leak that translates into several hundred tons of CO₂‑equivalent over a ten‑ to twenty‑year horizon. At carbon prices in the range of $20 to $100 per tCO2e, the present value of credits can offset a substantial fraction of a $50,000 to $75,000 average P&A cost (wider range of $20,000 to $250,000+). At portfolio scale, and when layered with federal or state cost-share, net costs could be reduced to levels where investors could target infrastructure‑style returns while delivering permanent methane abatement.

Figure 2 shows a high-level calculation of the notional value of carbon credits at different carbon prices for all documented orphan wells (which can benefit from federal and state-level incentive programs) and a portion of all estimated P&A candidates that currently exist in the US (based on industry work, about 25 percent of existing abandoned wells are considered high priority and therefore strong candidates for P&A work). From these estimates, the total size of the carbon credit market associated with abandoned wells over a fifteen-year period can range from $1 billion (at $20 per tCO2e for just documented orphan wells) to over $17 billion (at $100 per tCO2e for all high-priority abandoned wells).

The core challenge is not technical feasibility—P&A is a mature engineering activity—but rather the design of credible measurement, reporting, and verification (MRV) systems and carbon methodologies that turn physical methane reductions into trusted financial instruments.

Policy Tailwinds and Evolving Carbon‑Credit Framework

Public policy for orphan wells and methane has taken a two‑step path: first, a strong enabling push through the Infrastructure Investment and Jobs Act (IIJA), including the REGROW Act provisions, and more recently a reorientation of federal clean‑energy incentives under the One Big Beautiful Bill Act (OBBBA). Together, they create both opportunity and urgency for private, carbon‑linked P&A investment.

The IIJA remains the core federal framework for orphan‑well remediation. It authorized roughly $4.7 billion to plug, remediate, and reclaim orphaned wells on federal, state, tribal, and private lands, with approximately $4.3 billion earmarked for state‑level programs. These funds support building inventories, characterizing wells, measuring methane emissions, executing P&A, and undertaking surface restoration. By 2023, the Department of the Interior had distributed over $1 billion across dozens of states, allowing them to stand up orphan‑well units, launch multiyear plugging campaigns, and in some cases pilot more standardized approaches to methane measurement and site remediation. States such as Pennsylvania, Ohio, New Mexico, and Michigan have used this flexibility to design programs that prioritize high‑risk wells, embed local job‑creation criteria, and experiment with integrating federal dollars into broader plugging strategies.

The 2025 OBBBA substantially reshapes the wider clean‑energy incentive landscape but mostly at the margins of orphan‑well policy rather than at its core. OBBBA’s headline effect is to scale back and tighten many clean‑energy tax credits created under the Inflation Reduction Act—shortening deadlines, adding stringent domestic‑content and foreign‑entity restrictions, and accelerating phase‑outs for technologies such as wind, solar, and batteries. This shift reinforces the current administration’s emphasis on expanding domestic fossil‑fuel production and rolling back some climate‑policy supports while leaving IIJA’s orphan‑well authorizations largely intact. At the same time, related executive actions have slowed and scrutinized certain climate‑oriented programs, creating more uncertainty around the pace and consistency of future orphan‑well grant disbursements even where statutory funding remains in place.

The combined signal is nuanced but ultimately supportive of market‑driven methane‑abatement projects. IIJA ensures that a substantial pool of public capital exists to help states identify and plug orphan wells, build inventories, and develop local supply chains. OBBBA, by contrast, constrains some competing federal clean‑energy subsidies and underscores the political variability of climate‑related support. In this environment, high‑integrity P&A projects that monetize avoided methane through carbon credits—and treat federal or state grants as supplemental rather than foundational—are better positioned. They align with enduring state‑level priorities to address legacy environmental liabilities, tap into authorized (if unevenly deployed) IIJA funds, and rely on private demand—rather than on whichever tax incentive happens to be in favor in Washington—for verified methane abatements.

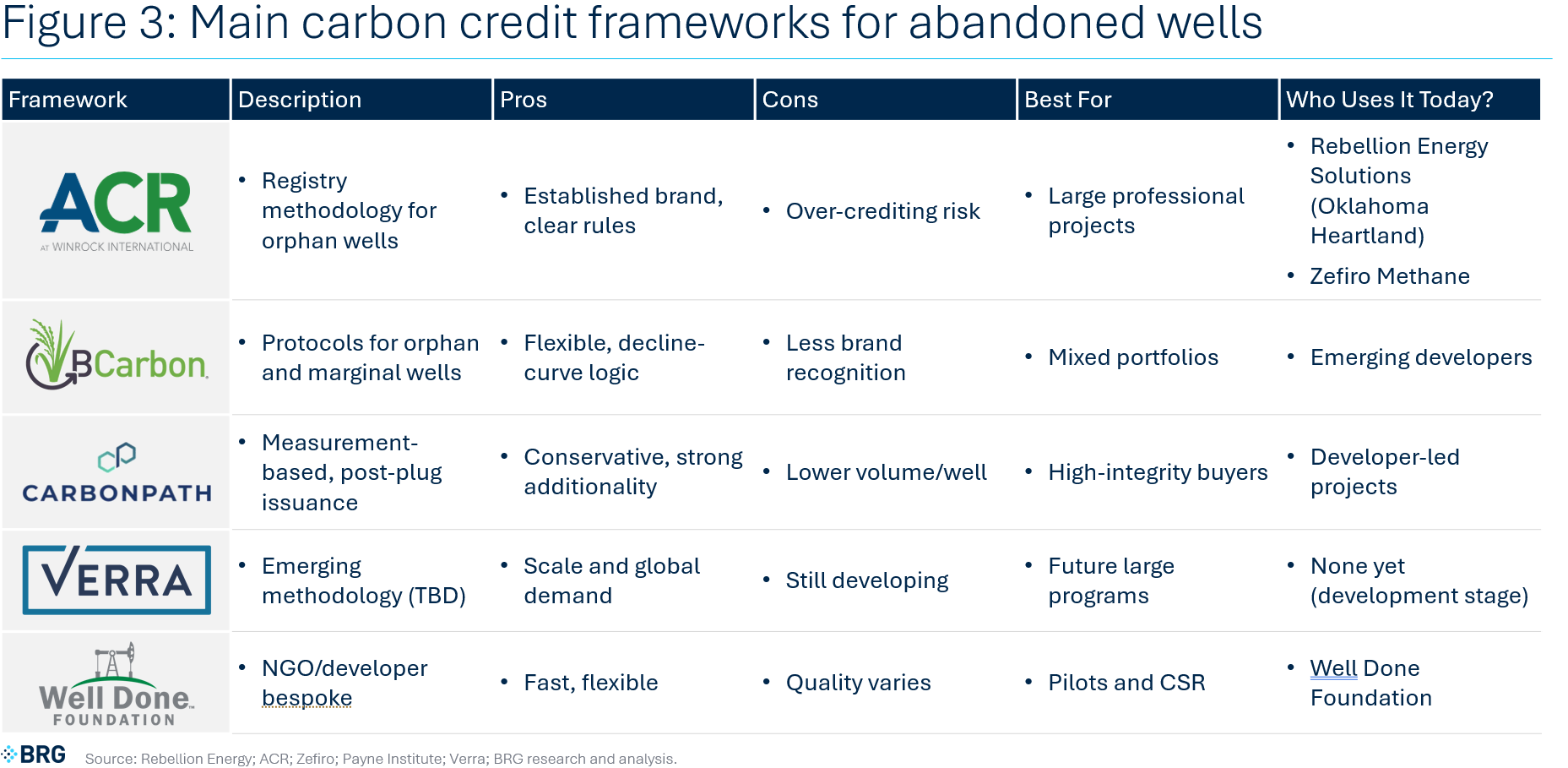

On the carbon‑credit side, methodologies dedicated to plugging orphan and idle wells continue to mature. These methodologies specifically address plugging of orphaned and inactive wells, providing a framework for:

- building eligibility criteria for wells and project types

- establishing baseline emissions, often using a combination of direct measurements and statistically derived factors

- defining project boundaries and leakage pathways

- setting crediting periods and decay curves for emissions over time

- specifying monitoring frequency, verification requirements, and conditions for reversal or underperformance

Several concrete frameworks and programs are in place or emerging that link P&A of abandoned/orphaned wells to carbon credits. The main frameworks are included below and summarized in Figure 3:

- American Carbon Registry (ACR):plugging orphaned oil and gas wells methodology

-

- ACR has developed a dedicated methodology for plugging orphaned oil and gas wells in the US and Canada, defining eligibility, baseline setting, monitoring, and crediting rules for methane reductions from P&A.

-

- It has been used in practice, with credits issued to projects such as the Oklahoma Heartland Methane Abatement & Land Restoration Project (Rebellion Energy Solutions).

- BCarbon: orphan and idle wells protocol

-

- BCarbon has created its own protocol for issuing credits from plugging orphan and idle wells, with a different emphasis on production history and decline‑curve approaches to estimate future emissions.

-

- It tends to model emissions as declining over time from a last‑known production rate, which contrasts with methodologies that assume a flat leak rate.

- CarbonPath: methane‑reduction methodology for wells

-

- CarbonPath offers a framework that issues credits based more tightly on measured current leak rates and shorter effective crediting horizons.

-

- Its approach is generally more conservative on future emissions compared with ACR and BCarbon, focusing on what is observed at the wellhead.

- Verra: methodology for plugging oil and natural gas wells to reduce GHG emissions (under development)

-

- Verra has proposed a new methodology specifically for projects that plug and abandon leaking oil and gas wells to reduce methane emissions.

-

- Once fully approved, it will provide a widely recognized route to generate credits under the Verra/VCS system for P&A‑based methane abatement.

- Project‑level implementations and “house” standards

-

- Nonprofit and private developers (for example, Well Done Foundation) are issuing or marketing credits from P&A projects, sometimes under registry methodologies and sometimes with their own high‑integrity project standards layered on top.

Crucially, these frameworks also allow for integration with public funding by addressing double‑counting risks and clarifying when wells financed primarily by grants may still generate credits. This combination of statutory IIJA support, evolving state‑level implementation choices, a more selective federal tax‑credit environment under OBBBA, and increasingly robust P&A‑specific methodologies defines the new policy backdrop: one where well‑designed, privately financed P&A‑for‑carbon projects can complement, rather than depend on, federal programs while delivering measurable, permanent methane reductions.

For investors, the implications are twofold. First, the existence of recognized methodologies reduces execution risk: there is a defined path from physical projects to tradable credits. Second, methodological choices—especially around baseline assumptions, crediting horizons, and discount factors—directly affect project economics. Savvy sponsors will pay close attention to the integrity and conservatism of the frameworks they adopt, both to protect reputational capital and to ensure that credits are attractive to high‑quality buyers.

Business Models and Financing Archetypes

A variety of commercial structures are emerging to monetize P&A as a carbon‑linked investment theme. Three archetypes are particularly relevant for E&Ps, oilfield service providers, and private capital:

1. Operator‑led P&A with embedded carbon monetization

In this model, upstream operators integrate carbon‑credit generation into their existing decommissioning programs. They identify candidates within their idle or nonproducing portfolios, partner with specialized developers and service providers to conduct baseline measurements, execute P&A, and monitor post‑closure performance.

The operator retains or shares the resulting carbon credits, which can be sold into voluntary markets, used to meet internal decarbonization commitments, or structured into offtake agreements. This approach:

a. reduces long‑term AROs while potentially offsetting a portion of P&A spending

b. demonstrates proactive methane‑reduction leadership to regulators and stakeholders

c. creates optionality around timing of credit monetization, allowing operators to manage exposure to future carbon prices

2. Remediation and infrastructure funds

Private equity and infrastructure investors can pursue a programmatic strategy: aggregate large portfolios of orphan or idle wells—often in partnership with states, tribal authorities, or operators—and finance P&A as a dedicated asset platform. Capital is deployed in stages to:

a. acquire or secure rights to remediate wells and any associated land

b. contract specialized oilfield service providers to execute P&A and site remediation at scale

c. implement MRV systems and enroll projects in one or more carbon‑credit registries

d. monetize credits through forward sales, spot transactions, or structured offtake with corporates seeking high‑integrity methane abatement

For investors, these vehicles resemble infrastructure credit or remediation funds: they feature relatively predictable capex, construction‑style risk during execution and then a stream of carbon‑credit and potentially grant‑related cash flows. Returns depend heavily on cost discipline, the quality and variability of baseline emissions, carbon‑price trajectories, and policy stability.

3. Specialist carbon project developers and aggregators

A third model focuses on specialist developers whose core capability lies in project origination, MRV design, and carbon‑market interface. These entities:

a. use data analytics, regulatory filings, and field surveys to identify high‑priority wells and clusters

b. design measurement campaigns and monitoring systems tailored to applicable methodologies

c. arrange financing from investors, corporates, or blended‑finance vehicles

d. contract field operations to oilfield service providers, which perform the physical plugging and remediation

e. aggregate credits into diversified portfolios for sale to buyers seeking volume and risk diversification

This structure can appeal to service companies that do not wish to take on credit‑market or methodology risk but want exposure to a scalable P&A opportunity. It also allows financial investors and corporate buyers to access the theme through structured products, rather than directly own wells or contract P&A activities themselves.

Each model depends critically on scalable, credible MRV infrastructure, standardized methodology, and legal clarity on who owns the credits and liability.

Economics, Risk, and Return: An Investor’s Lens

At the project level, the economics of P&A‑for‑carbon hinge on three variables: cost per well, baseline emissions per well, and realized carbon price. Each exhibits uncertainty and regional variation, but stylized ranges help frame the opportunity.

- Cost: Depending on depth, complexity, surface conditions, and contamination, P&A plus site remediation typically ranges from roughly $30,000 to $150,000 per well, with many projects clustered around $50,000 to $75,000, particularly legacy vertical wells in highly depleted conventional areas. Programmatic campaigns that standardize design, logistics, and contracting can drive down unit costs (see Figure 4).

- Baseline emissions: Field measurements show highly skewed distributions: many wells emit little or no methane, while a subset of “super‑emitters” accounts for a disproportionate share of total emissions. Project design that prioritizes higher‑emitting wells improves abatement cost‑effectiveness and credit yield.

- Carbon price and demand: Methane‑abatement credits, particularly those with strong MRV and permanence, have historically commanded premium pricing in voluntary markets. Future prices will depend on broader demand for high‑integrity offsets, the evolution of standards, and the degree to which compliance systems recognize such credits.

- State-level and federal support: Often the most decisive factor and includes grants, cost-share programs, and tax incentives linked to orphan-well remediation or methane reduction. Instruments that pay out upfront—covering a portion of the capital cost at the time of plugging rather than purchasing credits later—can materially lower the initial equity requirement without diluting future credit flows, effectively increasing project leverage and raising the internal rate of return. In portfolio terms, public funds absorb part of the downside and shorten payback, while carbon revenues and liability relief drive the upside, making P&A-for-carbon look less like a pure environmental spend and more like a blended-finance, infrastructure-style opportunity.

For institutional investors, several features stand out:

- Methane abatement via P&A offers high‑integrity, permanent emissions reductions that can meet increasingly stringent buyer criteria.

- Cash flows are largely uncorrelated with commodity prices and traditional upstream risks, aligning more closely with remediation and environmental‑infrastructure themes.

- Portfolio‑scale diversification—across states, basins, well types, and counterparties—can mitigate idiosyncratic technical and policy risks.

However, risks are real and must be priced. These include methodological changes, potential tightening of credit eligibility, evolving public perceptions of “transition‑related” credits, and the possibility that future regulations mandate plugging without crediting, compressing the window for monetization. Execution risk—both in field operations and MRV—also demands rigorous operational and governance frameworks.

Looking ahead, there will be a plausible additional value stream and/or avoided costs from emissions reductions at the portfolio level as buyers and regulators sharpen their focus on full-value-chain climate performance. For example, European liquefied natural gas (LNG) offtakers and certification schemes are increasingly interested in “cleaner molecules” that reflect not only low operational emissions but also reduced upstream methane leakage, including from abandoned wells. If robustly quantified and transparently reported, P&A-driven methane reductions could contribute to lower life-cycle emission factors for LNG cargos, improving access to premium markets or green certification pathways. While this benefit remains largely prospective today and sits outside the voluntary carbon credit revenue stack, it strengthens the strategic rationale for operators and LNG suppliers to integrate well-plugging into broader decarbonization and marketing strategies.

Strategic Implications for Key Stakeholders

Forward-thinking stakeholders across the value chain can act decisively to capture value from P&A-for-carbon today. E&P operators hold idle-well portfolios and ARO liabilities ripe for monetization. Oilfield service providers command the execution capacity to scale campaigns. Private equity and infrastructure investors can structure blended-return vehicles. Industrial buyers need high-integrity methane credits to meet residual emissions targets. Each has specific, immediate steps to turn emerging market dynamics into competitive advantage.

Exploration and production companies

The P&A‑for‑carbon theme for E&Ps is first and foremost a liability‑management and license‑to‑operate opportunity. Strategically, integrating carbon‑credit generation into decommissioning plans can:

- convert mandatory spending on asset retirement into partially self‑funding investments

- demonstrate proactive management of methane emissions from legacy operations

- create a portfolio of high‑quality credits that can be used to meet corporate net‑zero targets or sold to third parties

Companies that build internal capabilities around project selection, partner management, and MRV will be better positioned as regulators and investors scrutinize both operational methane and end‑of‑life practices.

Oilfield service providers

Service companies are critical execution partners: they possess the rigs, crews, and technical know‑how to design and execute P&A operations at scale. The emergence of carbon‑linked P&A creates avenues to:

- develop standardized packages for well assessment, plugging, remediation, and monitoring tailored to carbon methodologies

- enter performance‑linked contracts where compensation is partially tied to measured emissions reductions or credit issuance milestones

- partner with developers and investors to co‑design P&A campaigns that optimize both operational efficiency and credit yield

Oilfield services players that invest in measurement technologies, data integration, and MRV‑friendly workflows can differentiate themselves as “decarbonization service” providers rather than commodity contractors.

Private equity and infrastructure investors

For private capital, P&A portfolios can complement traditional energy and infrastructure holdings by offering:

- exposure to long‑dated, policy‑aligned cash flows

- a tangible, measurable climate‑impact story centered on permanent methane reductions

- the ability to structure vehicles that combine public funds, private equity, and carbon‑revenue streams

Investors will need to be disciplined on underwriting assumptions, particularly around carbon prices, policy risk, and distribution of leak rates. Partnerships with experienced operators and technical advisors will be essential to navigate the complex intersection of environmental regulation, subsurface engineering, and carbon markets.

Industrial buyers and end users

Large industrials—refiners, chemicals, steel, cement, and other hard‑to‑abate sectors—are a critical downstream constituency for P&A‑linked methane credits. Many companies have long‑dated net‑zero or intensity‑reduction commitments but face technical and economic limits to fully decarbonize their own operations in the near term. High‑integrity methane‑abatement credits from well plugging offer a way to complement on‑site reductions with verifiable, permanent emissions cuts rooted in the real economy rather than purely nature‑based or speculative technologies.

Strategically, P&A‑for‑carbon projects allow industrial buyers to diversify their decarbonization portfolios. Structured correctly, forward offtake agreements or long‑term credit purchase contracts can secure predictable volumes of high‑quality credits at known prices while giving project developers bankable revenue streams to finance multiyear plugging programs. For industrials, early engagement also creates reputational and policy benefits: supporting the cleanup of legacy oil and gas infrastructure aligns with broader societal expectations and can help demonstrate that their transition strategies extend beyond the fence line of their own facilities.

The window to shape this asset class is narrow. Stakeholders who move first—auditing portfolios, piloting projects, structuring offtake, and building partnerships—will establish technical standards, capture premium pricing, and secure preferred access to the highest-quality credits and work programs.

Commission a portfolio assessment today to identify your 1,000-well priority list, quantify baseline emissions, and model blended economics at prevailing carbon prices. First movers don’t just participate—they define the market.

Conclusion: Rewiring the End of the Oilfield Life Cycle

The energy transition conversation has focused heavily on new assets—renewables, storage, hydrogen, and carbon capture—while giving comparatively little attention to the back end of the oil and gas asset life cycle. Yet managing the legacy footprint is just as critical to achieve climate goals and maintain public support for the sector.

By reframing P&A as a methane‑abatement activity rather than a pure compliance cost, the industry can turn a large, underfunded liability into a climate‑positive, investable asset class. Millions of legacy wells, sizable public budgets, and maturing carbon‑credit frameworks create the preconditions for scale. The next step is execution: designing high‑integrity projects, building robust MRV systems, and aligning incentives among operators, service providers, investors, and regulators.

If structured with transparency, conservative assumptions, and strong governance, P&A‑for‑carbon could become one of the most credible and durable decarbonization plays available to investors—anchored not in speculative technology, but in addressing the very real methane footprint of the existing oil and gas system.

How BRG Can Help

Navigating the emerging landscape of emission-reduction initiatives—from carbon-credit mechanisms to methane-abatement investments—requires both strategic clarity and technical depth. BRG brings expertise across energy markets, asset valuation, policy analysis, and carbon accounting to help clients assess the economic potential and operational feasibility of new decarbonization pathways.

Whether evaluating the investment case for well-plugging, designing carbon-credit monetization strategies, or integrating emission-reduction projects into broader portfolio decisions, BRG supports energy companies, investors, and policymakers in turning environmental commitments into actionable business outcomes.

In short, BRG helps bridge the gap between transition ambition and financial performance—ensuring decarbonization efforts create measurable, verifiable, and lasting value.

[1] Sources include US Department of Energy (DOE); Environmental Protection Agency (EPA), “Inventory of U.S. Greenhouse Gas Emissions and Sinks 1990-2020: Updates for Abandoned Oil and Gas Wells” (April 2022); ACR, “Orphaned Gas Wells“; Visualizing Energy, “What are “orphaned” oil and gas wells and why should we care about them?” Boston University Institute for Global Sustainability (July 2023); Department of the Interior Bipartisan Infrastructure Law 40601 Report to Congress, Orphaned Well Program – Annual Report (November 2022).

Related Professionals

Prepare for what's next.

ThinkSet magazine, a BRG publication, provides nuanced, multifaceted thinking and expert guidance that help today’s business leaders adopt a more strategic, long-term mindset to prepare for what’s next.